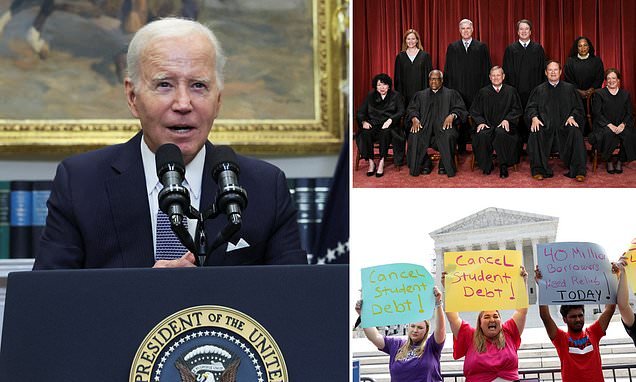

It’s straightforward to place off paying in your scholar loans, since some scholar mortgage compensation plans have compensation intervals upward of 20, 25, and 30 years. Nevertheless, when you don’t need to spend a couple of many years paying off your scholar loans, you may take steps proper now to pay them off quick.

Key Takeaways The extra you pay whilst you’re nonetheless in class, the much less curiosity will get added to your principal stability after commencement.

Some scholar mortgage lenders supply reductions only for activating autopay, permitting you to scale back how a lot you’ll pay in curiosity over the lifetime of your scholar loans.

For debtors with personal scholar loans (or a mixture of federal and personal scholar loans), refinancing scholar loans pays off your current loans, leaving you with one cost for the brand new refinanced mortgage.

1. Pay Whereas You’re in College

In case you’re at the moment a scholar, each little bit you may pay now will assist you to in the long term. In case you can afford to chip away at your loans whereas in class, then you definitely’ll owe much less once you graduate. You may even make funds throughout your six-month grace interval. The extra you pay earlier than your loans capitalize, the much less curiosity will get added to your principal stability after you permit faculty.

2. Pay Extra Than the Minimal

Primarily based on the dimensions of your mortgage, your compensation plan could have a minimal quantity that should be paid every month to repay that debt inside the compensation interval. Making the minimal cost is sufficient to hold you on observe along with your compensation plan, however nothing is stopping you from paying greater than the required quantity every month. In case you can add even only a few extra {dollars} to your minimal month-to-month cost, then you might start to shave months off of your compensation interval.

3. Make an Additional Fee

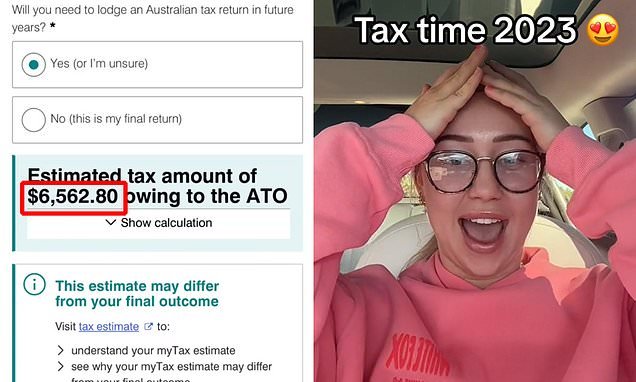

Whether or not you come into a piece bonus or get a pleasant tax refund, you should utilize a lump sum of additional money to pay down your scholar mortgage debt. You may pay towards your principal to give attention to reducing the general quantity you owe.

4. Activate Autopay

There’s nothing fairly like “set it and overlook it.” Some scholar mortgage lenders, together with federal loans, supply autopay reductions, so you might decrease how a lot you’ll pay in curiosity over the lifetime of your scholar loans as a profit for staying on observe along with your compensation interval.

5. Stick with the Normal Compensation Plan, If You Can

While you go away faculty, you’re routinely enrolled within the Normal Compensation Plan, which is ready that can assist you repay your loans in 10 years. That is the quickest compensation plan obtainable, and also you’ll pay the least in curiosity over your compensation interval. Evaluate this to income-driven compensation (IDR) plans, which have longer compensation intervals of both 20 or 25 years (relying on the plan).

Understand that IDR plans are usually less expensive than the Normal Compensation Plan. Debtors who go on IDR plans are typically in search of cost-effective funds and/or Public Service Mortgage Forgiveness (PSLF) over paying off their mortgage rapidly. Moreover, the month-to-month funds for IDR plans are usually set as a proportion of your discretionary revenue, whereas the Normal Compensation Plan relies in your excellent mortgage stability divided by 10 years. In consequence, every of the Normal Compensation Plan’s 120 funds is identical each month, whereas IDR plans can change yearly primarily based on household and revenue modifications.

6. Faucet into Worker Advantages

Some jobs and firms supply matching scholar mortgage compensation advantages. They’ll match your funds each month, as much as a specific amount. Employers can supply staff as much as $5,250 per yr in tax-free scholar mortgage compensation advantages by 2025. Not each firm gives scholar mortgage compensation matching, however you might need to ask your employer if they’ve any particular advantages like this. It might assist you to repay your loans a lot quicker.

7. Discover a Secondary Supply of Earnings

In case you’re struggling to seek out further funds to place towards paying down your scholar loans, contemplate turning a interest right into a supply of further revenue or use your further time to get entangled within the gig economic system. You could possibly ship groceries, stroll canine, promote do-it-yourself creations on-line, and so on. In case your major supply of revenue is used to pay your different payments, then you should utilize your secondary supply of revenue to chip away at your scholar mortgage debt.

8. Revise Your Price range

In case you’ve made a price range that solely has you making the minimal month-to-month cost, you’ll almost certainly take longer to repay your debt. When you’ve got the means, change your price range to give attention to paying off your scholar loans quicker. That may imply much less cash going towards different issues, similar to eating out, touring, or procuring. Releasing up these funds means you may commit extra money towards paying down your scholar loans.

9. Examine Tax Deductions

The coed mortgage curiosity deduction lets debtors declare as much as $2,500 in scholar mortgage curiosity funds from final yr, relying on their modified adjusted gross revenue (MAGI). You don’t must itemize deductions to assert this, and it’s obtainable forfederal and personal scholar loans. You then put this tax deduction towards paying down your scholar debt even additional. There is perhaps different deductions and credit for which you’re eligible.

The coed mortgage curiosity deduction is step by step diminished and finally phased out for higher-income taxpayers. For 2023, the MAGI phaseout for single, head-of-household, or qualifying widow(er) filers begins at $75,000 and ends at $90,000. If you’re married and submitting collectively, the MAGI phaseout begins at $155,000 and ends at $185,000. You may’t declare the deduction in case your MAGI is above the utmost restrict.

10. Look into Refinancing

When you’ve got personal scholar loans or a mixture of federal and personal scholar loans, you might need to take into consideration refinancing your scholar loans. Refinancing means you’ll take out a brand new, personal mortgage that pays off your current loans, and then you definitely’ll make one cost to your new, refinanced mortgage. Be sure you can get a decrease rate of interest than what you’re paying now and craft your compensation plan round what you may fairly afford. There are a number of scholar mortgage corporations for refinancing to select from, every with completely different advantages and rates of interest.

Do not forget that you lose all federal advantages and protections once you refinance, similar to PSLF eligibility and deferment and forbearance choices. Solely take this route when you don’t plan to make use of federal advantages.

What Is the Smartest Means To Pay Pupil Loans? Maybe the neatest technique to repay your scholar loans (in addition to one of many quickest) is to pay greater than your minimal cost. As you cut back the principal stability of your debt, the quantity of curiosity that you just’ll owe over the lifetime of the mortgage additionally decreases.

How Lengthy Do Most Folks Take To Pay Off Pupil Loans? Regardless of the Normal Compensation Plan having a compensation interval of 10 years, a 2013 research carried out by One Wisconsin Institute discovered that survey respondents reported taking 21 years on common to repay their scholar loans.

Is There a Draw back To Paying Off Pupil Loans Early? There could be a draw back to paying off your scholar loans early. In case you repay your scholar loans rapidly, any loans you are taking later could include the next rate of interest than they could usually. Lenders do that to offset the chance that additionally, you will repay the brand new loans quicker than anticipated (thereby stopping them from making extra money off of curiosity funds) by making you pay extra curiosity up entrance.

The Backside Line

Paying again your scholar loans would possibly really feel overwhelming, however there are a couple of other ways you could pay them off sooner. Set clear objectives, revise your price range, and make the most of employer advantages and academic tax breaks.

The extra you give attention to paying off your scholar loans proper now, the extra money you’ll have for your self when you do.