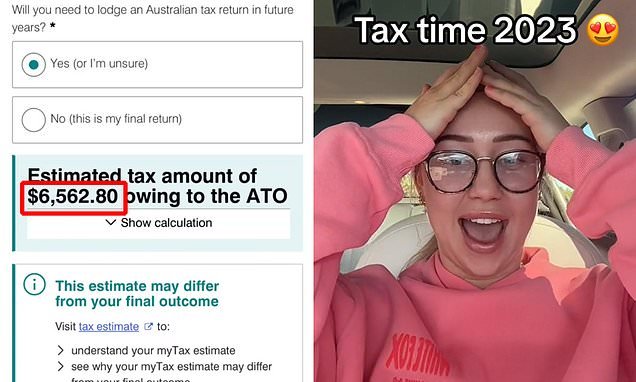

Many discovering they nonetheless owe cash to the ATO

College graduates with HECS money owed are among the many rising variety of Australians who’ve been stung by their tax returns after studying they owe cash to the ATO.

Australians struggling to repay their money owed have shared their horror tales after they acquired a invoice from the ATO as a substitute of cash returned to their hip pocket.

One girl, who goes by Lozrob96 on TikTok, stated her accomplice was compelled to pay $1,200 after submitting his tax return after July 1.

About 3million Aussies who nonetheless owe pupil money owed are being stung this tax season, with many being instructed they nonetheless owe the Australian Taxation Workplace once they have been getting ready for a refund

‘My accomplice has simply performed his tax return in the present day. Neither of us have ever had a tax invoice earlier than,’ she stated within the video.

‘He’s a part-time employee and a uni pupil and he owes the federal government $1200.’

‘However why do I owe $1200? I’ve by no means had a tax invoice earlier than. Oh sure so you already know that factor that you simply’re doing, so you possibly can construct a profession, in an effort to really f**king survive, that college diploma? Yeah, it is due to that.’

About 3million former college students have been compelled to pay a median of $1,700 extra on their HECS-HELP debt after indexation was utilized on June 1.

A number of college students had been hoping to obtain some a reimbursement come tax time on July 1, however have been instructed they owe cash – including to their debt burden.

A 21-year-old healthcare employee, nicknamed Abbs on TikTok, was ‘mortified’ when she was given a $3,249 invoice after wage sacrificing whereas she nonetheless had an unpaid pupil mortgage.

Alongside the 7.1 per cent enhance to her pupil loans, Abbs had additionally utilised wage packaging along with her employer, the place employees quit some pre-taxable earnings in return for advantages of an analogous worth, reminiscent of extra superannuation, a laptop computer and even kids’s’ college charges.

For individuals with excellent pupil debt, wage packaging also can add to money owed at tax time and explains why some might Aussies might owe the ATO slightly than obtain a reimbursement come tax time.

‘I simply did my tax return. If you happen to work in healthcare and have a HECS debt don’t, I repeat, don’t [use salary packaging] till you’ve f***ing paid off your HECS debt. I used to be mortified,’ she stated.

‘I really wish to cry. That’s what I wished to get again and now I’m f***ing paying it.

The acute quantities owed to the ATO are as a consequence of HECS/HELP money owed being elevated by 7.1 per cent on this yr’s indexation and the elimination of the low-and-middle earnings tax offset

‘I paid $18,000 in tax and I’ve to pay one other $3000 in tax,’ she stated.

‘F**okay the tax division.’

College college students who’ve been given a reimbursement have acquired a considerably smaller portion after the low-and-middle earnings tax offset (LMITO) was axed.

The tip of LMITO meant that Australians incomes $126,000 a yr or much less have been seeing $1,500 or much less on their tax return relying on how a lot they labored.

The restricted time LMITO – often known as the ‘lamington’ – ended on July 1 when Treasurer Jim Chalmers opted to not lengthen the measure.

Based on Canstar, about 10million individuals have been eligible for the LMITO, with the largest profit reserved for these incomes between $48,000 and $90,000.

Based on the ATO, these with pupil loans who made beneath $48,361 through the 2022-23 monetary yr weren’t compelled into making obligatory funds.

Nevertheless, anybody with a pupil mortgage who made between $48,361 and $55,836 have been compelled to at least one per cent of their mortgage again.

That quantity would then double for these receiving a wage from $55,837 to $59,186, and enhance in half per cent increments in brackets of about $3,000-$6,000 extra.

Probably the most somebody can be compelled to pay again this monetary yr was 10 per cent of their mortgage in the event that they made greater than $141,848.

The brackets will enhance for subsequent monetary yr, with the beginning wage to pay again pupil loans sitting at $51,550.